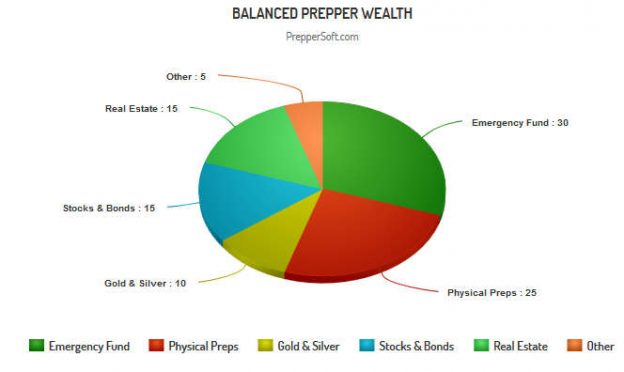

It’s that time of year again – Christmas is over, the first hints of warmer & longer days have arrived, and the dreaded April 15th tax deadline starts to loom closer. Before we’re totally focused on going outside and making preparations for the spring garden, now’s a good time to reflect on balanced prepping, specifically in terms of wealth distribution. It’s often the case that due to price fluctuations, life changes, or overallocation due to specific concerns, even a seasoned prepper’s distribution of wealth can become unbalanced & less diversified.

Editor’s Note: Nothing in this article should be construed as financial advice. The sole purpose in providing this information is for eduction and illustration. Consult a professional financial adviser for financial advice.

It’s interesting that just as this post is being published, SGTReport released an interesting video interview with Jerry Robinson from FollowTheMoney discussing wealth diversification and building income streams.

Even if you don’t believe the hype from the “dollar is going to die tomorrow” crowd, there are definitely some key things to consider in terms of wealth diversification.

The most likely disasters are personal ones that affect only your family. Of these, the two most common are job loss and serious illness/accident. For the near term future, your big potential expenses such as mortgage, car repair, health care, etc. are all denominated in dollars. Your bank isn’t ready to take mortgage payments in BitCoin yet, and you’re mechanic probably won’t fix your car in exchange for some of your food storage. For this reason, it’s important to have a cash emergency fund. If that job loss happens, or you’re injured/sick and unable to work for a while, nothing beats having cold hard cash to pay the necessary bills. Six months of expenses is a good target to shoot for. If you’re not there yet, consider putting off some prep gear purchases and save up instead. If your mandatory expenses have increased, it might be that what would have lasted you six months no longer will.

Banks & brokerages can and do fail; diversify your savings. While the FDIC and other government insurance schemes are supposed to cover depositors in the event of failure, it’s well known that these entities don’t have the funds to cover everyone should another massive round of bank failures potentially hit. As a depositor, you’re basically an unsecured creditor of the bank, and there are already “bail-in” provisions in place so that if the worst happens it may be possible you end up with a “haircut”. We have seen that in Cyprus and Greece already, and it is not impossible it could happen in America. The best defense is to spread your emergency fund across several well capitalized banks. Banks are required to publish their balance sheets and a quick read can help determined which banks are healthier than others. Reading & understanding a balance sheet is a great prepper skill to develop at the same time. If you have serious amounts of cash, it might be worth considering holding some of that in overseas institutions as well, just as an extra hedge against the domestic financial system becoming unstable.

It is also a good idea to keep some physical cash on hand. In the event that a bank holiday is ever declared again, as it was in the 30s, some physical cash on hand will help meet short term needs. Again we saw this happen in Greece not long ago, and when banks were allowed to re-open, withdraws were subject to a daily limit. How much cash to keep on hand vs. how many banks to spread the rest across is a highly personal decision subject to individual circumstances.

Physical precious metals might be a part of your diversification strategy. Many new preppers come into the community after being frightened about the dollar’s imminent crash, and have a tendency to want to take all out of their wealth out of the system and pile it all into gold & silver. After the panic subsides, calmer heads usually prevail. The old adage still applies: “don’t put all your eggs in one basket”.

The prevailing wisdom within the community on this topic generally seems to be that anywhere  from 2 to 15% of your net wealth above and beyond the emergency fund might be reasonable as a precious metal allocation strategy. Of course this is your net wealth, so if your assets minus your liabilities is negative, or less than your required emergency fund, you likely should not consider even owning metals. It would be much more productive to pay down debt or add to your emergency fund or food storage.

from 2 to 15% of your net wealth above and beyond the emergency fund might be reasonable as a precious metal allocation strategy. Of course this is your net wealth, so if your assets minus your liabilities is negative, or less than your required emergency fund, you likely should not consider even owning metals. It would be much more productive to pay down debt or add to your emergency fund or food storage.

Stay balanced and don’t give in to fear or hype. The dollar is still king at the moment, but just as you can’t eat gold, you can’t 100% guarantee you can eat dollars either. In a serious SHTF catastrophe, food and water may not be available at any price.

Remember:

- Your physical preps (gear, food, water, etc) are in place for getting you through disasters, regardless of system availability.

- Your dollar-based emergency fund is for getting you through personal financial disasters, or crises where the system is at least mostly available.

- Your precious metal preps are there in case of national financial disasters.

- Other wealth is investment / speculation hoping to grow your nest egg. Real estate, stocks, etc.

It’s important to revisit & re-balance allocations between these categories at least once a year based on your up to date situation & goals.

Editor’s Note: Nothing in this article should be construed as financial advice. The sole purpose in providing this information is for eduction and illustration. Consult a professional financial adviser for financial advice.